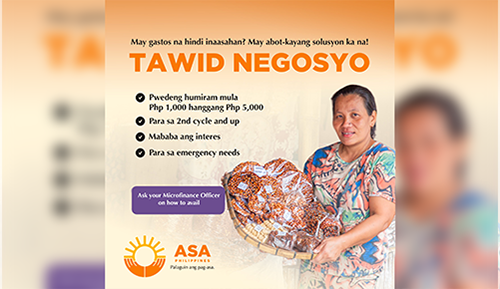

ASA Philippines launches "Tawid Negosyo" Program to help microentrepreneur clients bridge urgent financial gaps

ASA Philippines Foundation recently announced the launch of its Tawid Negosyo Financing Program, a new financial assistance initiative designed to provide immediate support to its women clients facing unforeseen financial challenges. The program aims to protect clients’ business capital from being depleted by emergencies, ensuring long-term business stability and resilience.

The initiative was developed in response to the growing financial instability faced by low-income households. ASA clients are often confronted with a combination of pressures, including rising food and utility costs, unpredictable weather events, and unexpected family illnesses. These challenges, coupled with social and cultural obligations, can quickly exhaust a family’s savings and income. When emergencies strike, many entrepreneurs are forced to use their business capital as a short-term solution, a practice that often leads to long-term disruption when the capital is not fully restored.

The Tawid Negosyo program is designed to bridge this critical gap, offering a reliable alternative to predatory lenders. It addresses urgent cash needs for a variety of “unforeseen situations,” which can include business-related urgencies, such as vehicle maintenance or utility bills; expenses related to hospitalization, medical needs, and burials; non-tuition educational expenses that were historically funded by usurious money lenders.

“Our clients are some of the most resilient and resourceful entrepreneurs in the country, but even the best-laid plans can be upended by a sudden crisis,” said Rapa C. Lopa, President and CEO of ASA Philippines Foundation. “The Tawid Negosyo program is our commitment to being a steadfast partner, especially when times are tough. It is a bridge—a ‘tawid’—to see them through an emergency without forcing them to sacrifice the business they’ve worked so hard to build. We are here to offer a hand with compassion and integrity, ensuring their journey toward a better life continues uninterrupted.”

Key features of the Tawid Negosyo Financing Program include:

- Financing Amounts: A minimum of P1,000 and a maximum of P5,000.

- Affordable Terms: Clients can choose from three repayment terms: 4 weeks with 2% interest, 8 weeks with 4% interest, or 10 weeks with 6% interest, all with affordable weekly payments.

- No CBU Requirement: The program does not require a Capital Build-Up (CBU) deposit or savings.

To be eligible, clients must be in their second loan cycle or beyond, have no outstanding past due balances, and have no more than three late payments within the past six months.